NeoGrowth Makes Historic Move by Listing Foreign Currency Bonds in GIFT City’s IFSC

NeoGrowth Makes Historic Move by Listing Foreign Currency Bonds in GIFT City’s IFSC : NeoGrowth lists the first Foreign Currency bond (FCB) at India International Exchange (IFSC) Ltd Exchange (IFSC), GIFT City from Developing World Markets (“DWM”). This also makes NeoGrowth, the first issuer to leverage the unified depository at GIFT City – India International depository IFSC Ltd.

MSME-focused digital lender NeoGrowth achieved a significant milestone by becoming the inaugural company to utilize the unified depository in GIFT City. The SME lender proudly announced on Thursday that its currency bonds, valued at ₹3.5 million (approximately Rs 32 crore), have been listed from developing world markets at the International Financial Services Centre (IFSC) in GIFT City.

NeoGrowth Makes Historic Move by Listing Foreign Currency Bonds in GIFT City’s IFSC : Transformative Opportunities

Arun Nayyar, MD and CEO of NeoGrowth emphasized the transformative prospects offered by the IFSC at GIFT City for Indian companies seeking offshore funds within the country. He expressed optimism that as this initiative gains traction, it will not only enable financial institutions like NeoGrowth to diversify funding sources but also create opportunities for other industries to explore funding beyond traditional channels.

Direct Listing on International Exchanges Opens Doors for Indian Companies

With the ability for Indian companies to now list directly on international exchanges in GIFT City, they gain access to a broader investor pool. Finance Minister Nirmala Sitharaman’s announcement of this move, subject to government notification, is poised to reshape the landscape of financial opportunities for businesses in India.

Government’s Official Communication

The Finance Ministry, through a released statement, disclosed that the Department of Economic Affairs has issued a notification detailing the terms and conditions for the direct listing of Indian companies in GIFT-IFSC.

Simultaneously, the Ministry of Corporate Affairs (MCA) has rolled out the Companies (List of Equity Shares in Permissible Jurisdiction) Rules, 2024, providing a comprehensive framework for Indian public sector companies to issue and list their shares on international exchanges.

Attracting Foreign Investors and Facilitating Growth

The direct listing of Indian companies in GIFT City is poised to simplify the investment process for foreign investors. Notably, they will no longer be required to convert their currency into rupees to invest in the shares of these companies. This strategic move allows stocks to be traded in dollars, eliminating the need for currency conversion and hedging, ultimately lowering associated costs.

The Finance Ministry expressed optimism, stating, “This initiative will encourage foreign investment, open growth opportunities, and expand the investor base for Indian companies.” Meanwhile, the Securities and Exchange Board of India (SEBI) is actively working on issuing guidelines to further streamline the process for listed Indian companies.

NeoGrowth will allocate the funds for advancing its onward lending initiatives to support its MSME portfolio customers.

Commenting on the successful listing, Arun Nayyar, Managing Director & CEO, NeoGrowth, said: “The IFSC at GIFT City is a transformative prospect for Indian companies to secure offshore funds right here in India and we, at NeoGrowth, are proud to participate in this. As the initiative gathers traction it will not only help financial institutions like NeoGrowth to diversify our funding sources but also pave the way for other industries to seek funding beyond traditional channels.”

NeoGrowth presently has an impressive INR 2,298 Crore in Assets Under Management (AUM). Since its inception, the company has successfully engaged with over 1,50,000 MSMEs, disbursing loans exceeding USD 1.1 Billion (over INR 10,000 Crore). As a leading SME lender in India, NeoGrowth has consistently achieved profitability over the past quarters, propelled by a comprehensive product suite, a robust data-driven underwriting model, profound customer engagement, and formidable data science capabilities throughout the value chain.

The company specializes in offering loans to small businesses, leveraging digital transactions and cash flow underwriting to assess business health. NeoGrowth’s lending initiatives are dedicated to promoting financial inclusion for first-time entrepreneurs, women business owners, and underserved small businesses. Operating across 70+ segments, from neighborhood Kirana stores to emerging eateries and upscale salon operators, NeoGrowth delivers technology-driven, swift, and hassle-free loans to MSMEs in over 25 locations across India.

NeoGrowth’s success is further fortified by the backing of esteemed investors such as Lightrock, Khosla Impact, Accion Frontier Inclusion Fund – Quona Capital, IIFL Seed Ventures Fund and Leapfrog Investments.

Brief overview of NeoGrowth and its significance in the financial industry

First things first, let’s talk NeoGrowth. If you haven’t heard of them yet, you’re in for a treat! NeoGrowth isn’t your average financial firm—it’s a trailblazer in the fintech realm, known for its innovative solutions and customer-centric approach. From small businesses to big corporations, NeoGrowth has been making waves in the Indian financial landscape, empowering entrepreneurs and fueling economic growth.

Explanation of the historic move of listing foreign currency bonds in GIFT City’s IFSC

Now, onto the main event: NeoGrowth’s bold decision to list foreign currency bonds in GIFT City’s IFSC. It’s not just any move—it’s historic, it’s game-changing, and it’s setting the bar sky-high for financial innovation. But what exactly does this mean? Well, stick around, and we’ll break it down for you, step by step.

NeoGrowth Makes Historic Move by Listing Foreign Currency Bonds in GIFT City’s IFSC : Purpose of the outline

But before we jump into the nitty-gritty, let’s set the stage. This outline isn’t just about NeoGrowth’s latest feat—it’s a roadmap to understanding the dynamic world of financial markets, regulatory frameworks, and the limitless potential of GIFT City’s IFSC. So whether you’re a seasoned investor, a curious entrepreneur, or just someone with a passion for finance, get ready to be inspired, informed, and maybe even a little awestruck by what’s in store!

FAQ

Is GIFT City and IFSC same?

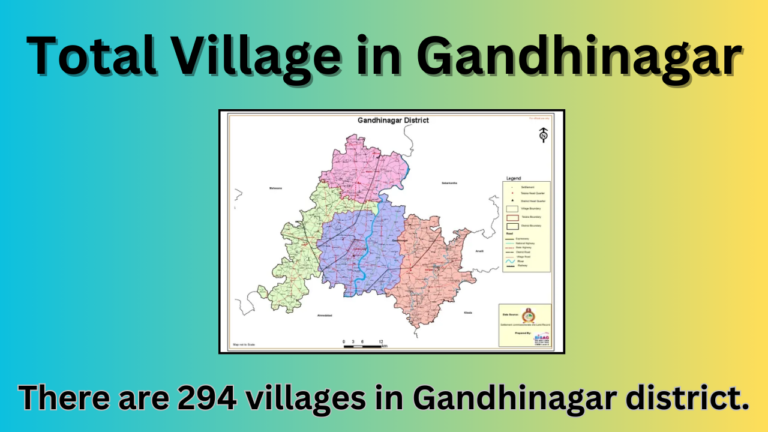

Gujarat International Finance Tech-city (GIFT) SEZ is India’s first International Financial Services Centre (IFSC) under Special Economic Zone Act, 2005 (“SEZ Act 2005”). It is being developed as a global financial services hub.

Which bank has IFSC banking unit in GIFT City?

Bank of India, on Wednesday, inaugurated its IFSC Banking Unit (IBU) in the International Financial Services Centre at GIFT SEZ area in Gandhinagar.

What is the full form of IFSC city?

The IFSCA is a unified authority for the development and regulation of financial products, financial services and financial institutions in the International Financial Services Centre (IFSC) in India. At present, the GIFT IFSC is the maiden international financial services centre in India.

What is a banking unit in IFSC?

IFSC Banking Unit(IBU) is a bank that operates from an International Financial Service Centre permitted by the Reserve Bank of India under the Banking Regulation Act, of 1949.

Who created IFSC?

Gujarat International Finance Tec-City (GIFT City) multi services special economic zone (SEZ) has set up the first International Financial Service Centre in India (IFSC) in accordance with the SEZ Act 2005 (SEZ Act), SEZ Rules 2006 and the regulations made thereunder.